Debt Pay Off Manager app for iPhone and iPad

Developer: Rakesh Chellaboina

First release : 28 May 2014

App size: 14.64 Mb

Debt Control helps you organize, manage and pay off your debts. Primarily, it includes tools to help you plan a strategy and analyze the results of using the Debt Snowball method, which is the debt-clearing model recommended by leading debt advisors.

Getting out of debt made easy. Pay off your debts with Debt Snowball method and save!

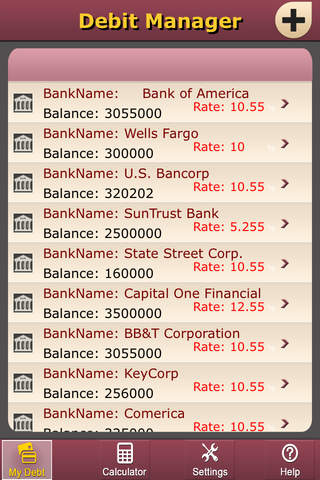

++ One clear screen to manage all your debts (credit cards, loans and mortgages).

++ Debt Free Date is calculated automatically.

++ Individual Pay Off Date is displayed under each of your debts.

++ One Tap to enter a payment

++ Payments with custom amounts

++ Built-in calculator

PAY OFF STRATEGIES SNOWBALL METHOD

++ Highest interest rate

++ Lowest balance

++ Highest balance

++ Custom order

++ Summary shows your payoff progress

++ An unlimited number of debts can be entered

++ each debt can be individually analyzed

++ payments may be entered as a percentage of balance

++ support for introductory rates e.g. 0% for 6 months

++ Monthly Payments may be recorded

++ allows you to keep track of your progress

++ Choice of payment periods

++ handles monthly, weekly and fortnightly payments

++ Extra Payments can be entered against each debt

++ helps pay off your debts even faster

++ can be entered Monthly, Yearly or as a One Off

++ Transactions can be entered against each debt

++ allows you to take into account expenses/purchases

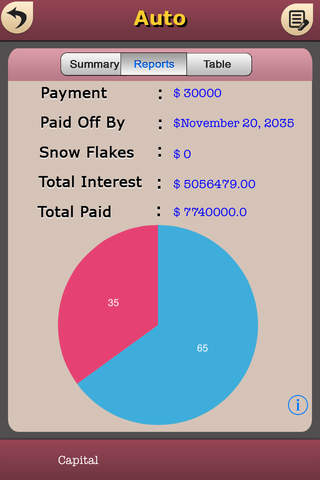

++ Interactive reports

++ easy visualization of the debt breakdown

++ compare debts side by side

++ Set of Calculators are included to help you compute:

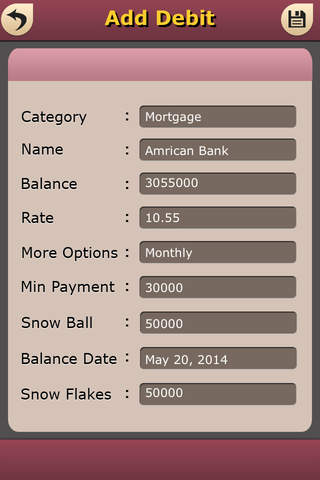

++ Handles Mortgage, credit cards, loans, other

++ Percent paid progress bar

++ Debt-snowball method: multiple payoff strategies

++ Extra payment tracking

++ Mortgage and loan calculators

++ Fixed/ARM interest rates, daily/monthly interest accrual

++ Payoff date calculator

++ Debt Payoff Graph with Snowball on and off

++ Annual Interest Rate

++ Amortization Schedule

++ Select either dollars, euros, pounds, yen or a custom currency

++ See your planned debt-free date. Compare & contrast how long itd take to pay off all debts if you werent using the snowball.

++ Prioritize debts the way you prefer (lowest balance, highest interest, or any order at all)